As a founding member and financial advisor at Paragon Wealth Management, I’m proud of the robust selection of financial planning services we offer. I wrote this article to provide a snapshot of our knowledge and experience and also demonstrate how you can participate in the planning process.

Let’s start by briefly exploring our service offerings and how they help. Then we’ll take a look at our e-money software portal that enables our clients to take part in their own financial planning.

Financial Planning Services

As an independent financial services team, we have complete access to any product available. This allows you the freedom to choose the ideal set of financial planning services to help you achieve your financial goals.

Services we offer include:

- Investment Strategy: Investments are an integral part of planning for your financial future. Together, we create a list of realistic short- and long-term objectives. From there, we build and actively manage an investment portfolio that’s been designed precisely to align with your investment goals.

- Retirement Planning: Start saving for retirement now. Our team has the skills and background to collaborate with you to identify your retirement objectives, evaluate your retirement requirements, and develop a strategy for leading a fulfilling retirement.

- Education Funding: Give your kids access to the best education possible. Our education funding knowledge enables you to give your kids a solid foundation for a successful future.

- Estate Planning: Provide your family with a thorough bereavement plan to feel confident you’re leaving a lasting legacy. We collaborate with you to create a strategy that assesses trust alternatives, considers gift-giving tactics, and efficiently organizes your legacy.

- Debt Analysis and Spending Strategy: A financial strategy is only as effective as your ability to control your spending and handle debt. We collaborate with you to conduct a thorough debt analysis and create spending plans that enable you to utilize money as a tool to shape your future.

- Insurance: Are you shielded? Our team has the knowledge and experience to properly assess your insurance needs, execute a thorough study of your existing policies, and choose the level of protection that fits your needs.

- Income Tax Reduction Strategies: Don’t pay the IRS more than you actually owe. By collaborating with you, our professionals examine your financial records to find the ideal ways to manage your contributions and optimize your tax benefits.

- Group Healthcare and Retirement Options: While the healthcare system might be complex, providing benefits to employees shouldn’t be. Let our team help you with group retirement and employee healthcare choices so you can keep your team moving in the right direction.

- Long-Term Care and Disability Cost Analysis: You shouldn’t let an injury compromise your financial independence. Let our advisors walk you through the various coverage options for disability and long-term care.

Client Participation Software Portal

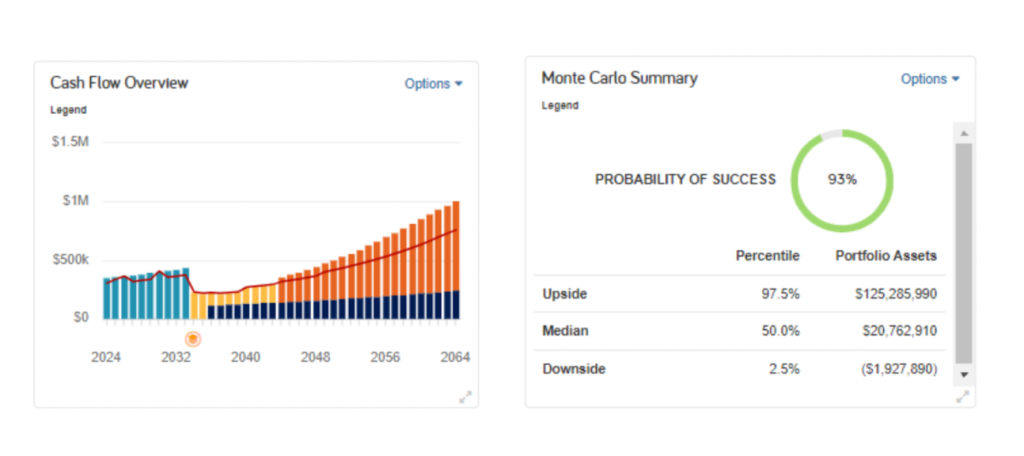

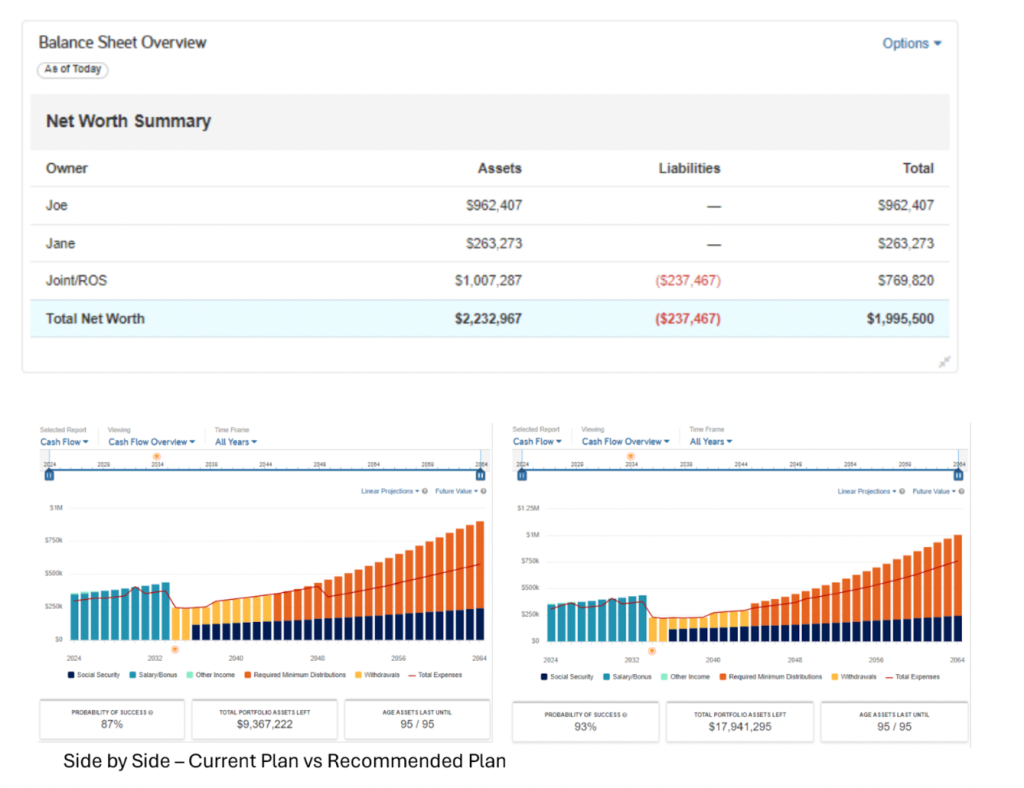

Whichever financial planning service(s) you ultimately choose, Paragon works with you by using a tool called eMoney. eMoney lets you participate in and monitor the service you selected by letting you make adjustments to your financial pla, see the impact of your decisions, and celebrate wins, together.

Take a look at the eMoney screenshots below for a fictional couple named Joe and Jane Sample. The screenshots provide both an advisor’s view and a depiction of the same information from the client’s perspective.

Let’s start with the advisor’s view:

Now let’s take a look at the same information as seen from Joe and Jane Sample’s dashboard:

Start Working With Us Now

We’re dedicated to professionally supporting, educating, and providing informed direction to each and every one of our clients.

When you’re ready to work with us and leverage our knowledge and experience along with the collaborative potential the eMoney software provides, reach out.

To schedule a meeting, call (215) 543-6576 or email phil@paragon-wealth.com.

About Philip

Philip Rosenau is Financial Advisor and Founding Partner at Paragon Wealth Management, a financial services firm based in Doylestown, Pennsylvania, dedicated to professionally supporting, educating, and providing informed direction to each and every client. As a lifelong resident of Bucks County and the son of a local entrepreneur, Phil understands the unique needs of small business owners. His clients rely on him to build a manageable road map toward their goals, and he takes pride in providing them with the knowledge to understand their unique financial situation, and helping them navigate their financial future with confidence.

Phil obtained a bachelor’s degree in economics with a minor in business management from Drew University, and his passion for creating and maintaining business relationships drove him to join the team at Paragon Wealth Management. Outside of the office, Phil enjoys spending time with his wife, Caroline, and two children. He is a member of the MDM networking group, active with the local CrossFit community, and is also proud to be part of the Drew University Lacrosse Legacy, where he played all four years. To learn more about Phil, connect with him on LinkedIn.